Learn How to Sell Covered Calls

Educated Investors Are Successful Investors

We believe in empowering our clients through education, helping them invest confidently with our ongoing support.

Start with our Free Courses

Learn Three Core Components of the Snider Method

Begin with our course on selling covered calls, then explore our other free options education courses. Learn about the key components of the Snider Method and how they can be combined to meet your investment objectives.

Selling Covered Calls Explained

Selling covered calls involves granting the call option buyer the right to buy your owned shares at a predetermined price, known as the strike price, within a specific time limit, often referred to as the expiration date.

The buyer of the call has the right to exercise their option anytime before the expiration date. Should they decide to do so — resulting in the stock being called away — the shares are automatically transferred to the option buyer. It’s worth noting that most stocks have options expirations that expire on the third Friday of each month. However, with the growth of options trading, you can find stocks with expirations on a weekly basis.

Selling Covered Calls

Investors seeking regular income can engage in selling covered calls, which allows them to collect premiums consistently. The practice of selling covered calls can also serve as a strategy to exit an existing stock position or provide a measure of downside protection.

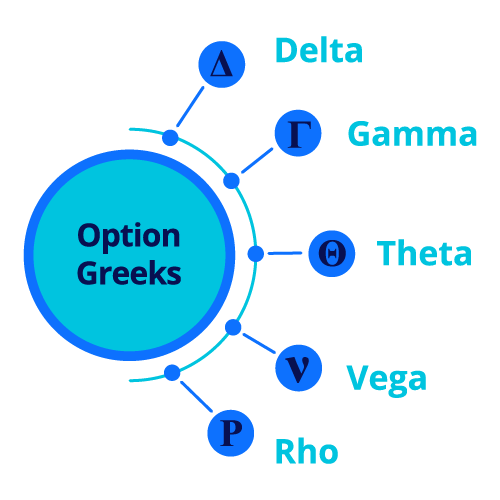

Although selling covered calls is simpler than most option strategies, a foundational understanding of options and their functionality is essential for successfully engaging in selling covered calls.

The Snider Investment Method expands on the valuable investment strategy of selling covered calls. We designed a long-term strategy to create income from your portfolio. Our investment techniques applied in a specific sequence allows our investors the potential to maximize their retirement income.

Generate Income and Reduce Risk

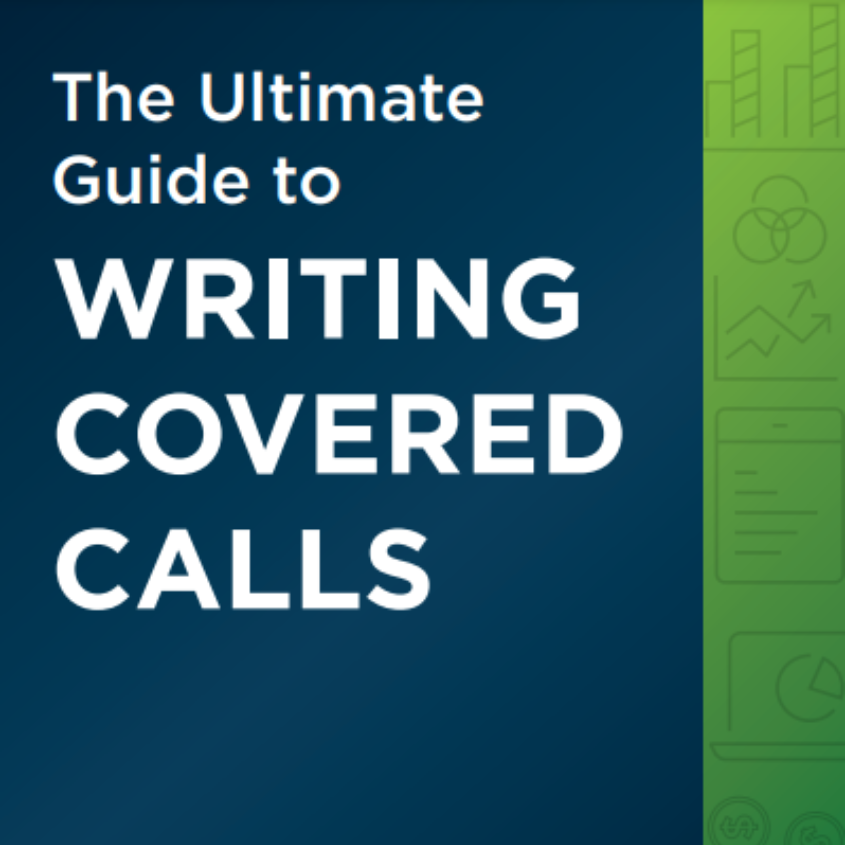

The Ultimate Guide to Writing Covered Calls

This free eBook includes 36 pages of material devoted to writing covered calls. This is the perfect guide for any new covered call investor.

Selling Cash-Secured Puts

Selling cash-secured puts and covered calls are similar in that both are options strategies used to generate income, and they each involve selling options. They also both require the seller to have the resources to fulfill the obligations of the option contracts if they are exercised.

Selling Cash-Secured Puts

When you sell a covered call, you own the underlying stock and are willing to sell it at the strike price if the option is exercised. Thus, the “cover” is the stock you already own.

In contrast, when you sell a cash-secured put, you have the cash necessary to buy the underlying stock at the strike price if the option is exercised.

Both strategies can be profitable with a neutral to slightly bullish outlook on the stock. Covered calls generate income from stocks you already own, while cash-secured puts allow you to buy stocks at lower prices or earn premiums.

Both strategies involve a degree of risk but can be profitable if used correctly. They are typically used when you have a neutral to slightly bullish outlook on the underlying security. However, there are key differences: with a covered call, you already own the stock and are looking to generate additional income or sell the stock at a certain price, whereas with a cash-secured put, you’re typically looking to buy the stock at a lower price or simply earn the premium from selling the put option.

Instant Download

Snider Investment Method Owners Manual

Our plain-English guide to the Snider Investment Method. Everything you need to know about our investment strategy in one, easy-to-read booklet.

Selling Options for Income in Bear Markets

A combination of cash management and managing risks keeps our portfolios generating an income even when stock prices decline. This critical factor gives our investors the ability to maintain their income even in bear markets. With market declines happening every few years, retirees must have a plan in place to handle stock market volatility.

Generating Income in Bear Markets

The Snider Method has simplified the subject of risk management into a rule-based approach we refer to as laddering. Laddering is a simple concept most often used by investors in certificates of deposit and bonds.

Laddering covered calls is a similar concept. Only, instead of smoothing fluctuations in interest rates, the idea is to even out variations in stock prices. Each purchase made as the stock price declines will lower your cost basis, which lowers the bar to be able to close the position at a profit.

As you accumulate additional shares each month, you may be able to sell more calls – generating even more income. If you are called away above your cost basis, you close the position at a profit, and you can start the process again. If there are no calls available above your total cost basis, you may be able to sell calls against some of your lower-priced shares to still generate income.

Investor Education

Free Option Trading Courses

We pride ourselves on empowering both beginner and experienced investors. As covered call advisors, we use our extensive knowledge to train our clients to write covered calls and boost the income from their portfolios.

Selling Covered Calls 101

Learn one of the most popular option strategies. Covered calls are a great way to boost income from a stock portfolio.

Stock Selection 101

Learn our criteria for choosing the right stocks for our strategy. Find stocks to meet your goals, risk tolerance, and time horizon.

Climbing to Profits

Learn a strategy to utilize covered calls through bear markets. Generate an income even when stock prices decline.

Managing

Investor Emotions

Learn the impact emotions, like fear and greed, play on your decision-making.

Option Investing 101

Understand the risks and benefits of options trading. Learn the most common option strategies with a focus on portfolio income.