Fear and Greed in Investing

Managing Investor Emotions

Learn the biggest enemy of individual investment performance and how to conquer it. Uncover the link between human emotions and investment performance.

Fear and Greed in Investing

Take Control of Your Emotions Like an Investment Professional

Few things make us as emotional as the prospect of losing money. As humans, we are hardwired to seek out predators and react to warning signals. While this innate behavior may have helped keep our ancestors alive, it also makes it almost impossible to make good investment decisions. That’s why investing is a continual struggle between logic and emotion.

Discipline is the best strategy for avoiding paying the high cost of following your emotions. Follow a rule-based system that is designed to address the human condition. The Snider Investment Method never relies on emotions or gut feelings to determine when to buy or sell.

Course Overview

Managing Investor Emotions: How to Avoid Bad Decisions

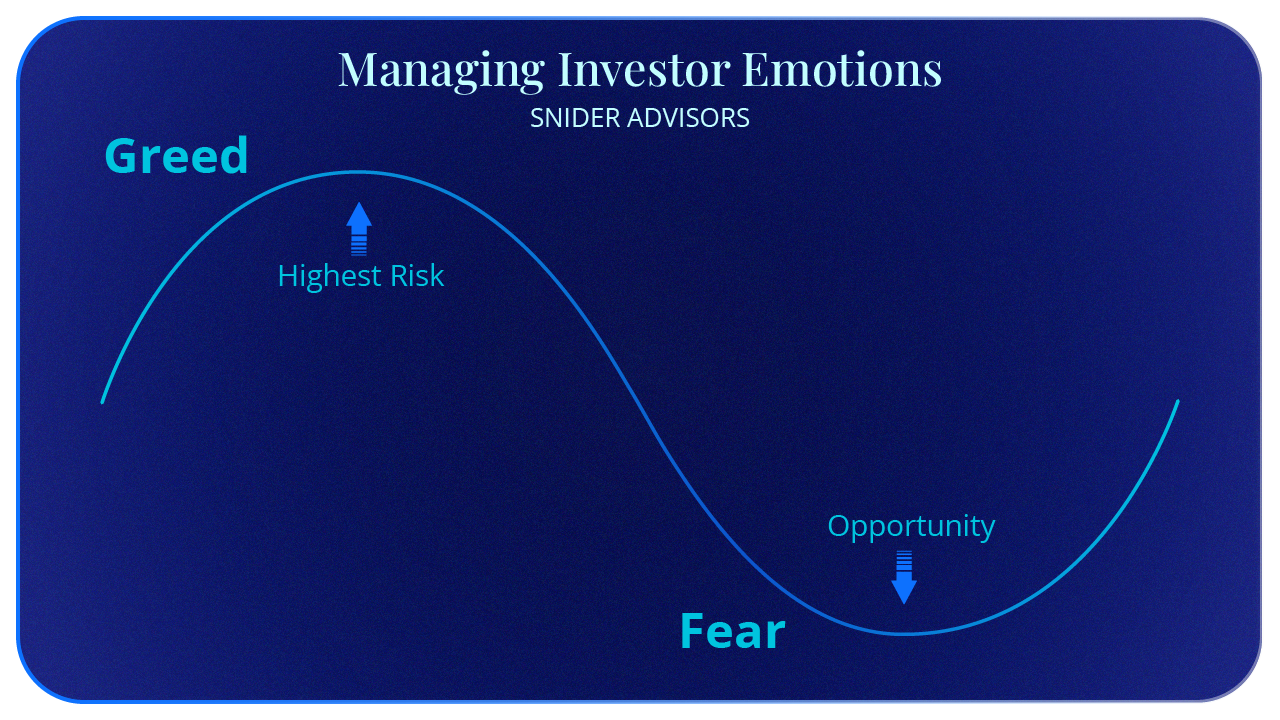

Fear and greed are the most influential emotions when it comes to investing. Each will lead an investor to make irrational decisions. Greed forces investors to add risk, chase the hot stock, or neglect diversification. Fear will peak in market downturns driving an investor to the safety of cash.

Overconfidence is often the biggest driver to feed the greed that harms both professional and retail investors. It creates an inflated view of your knowledge, ability, and control over investment outcomes. Believing too strongly in a strategy or stock can create excessive risk exposing a portfolio to large losses.

Panic selling is the best example of the negative effects that fear can play on an investment. Fear spikes when a security experiences a large decline in value. Alarming news or greater uncertainty trigger the panic selling that will lock-in those losses. Fear of losing money prompts irrational sales without consideration of the long-term potential or the underlying fundamentals of a stock.

Avoiding pain and pursuing comfort is the healthy, innate, human response to situations. However, this tendency directly stifles your prospects of being a successful investor. Learn the strategies you can use to make more informed decisions, deliberate investment choices, and reduce the influence of emotions on your financial decisions.

Start Managing Investor Emotions today to use these concepts in your portfolio management.

What is in the course?

Managing Investor Emotions

Mitigate the impact of emotional investing to generate more consistent, successful outcomes.

Logic vs. Emotions

Human nature can interfere with a person’s ability to make sound financial decisions.

Rule-Based Systems

Never rely on emotions or gut feelings to determine when to buy or sell.

Fear & Greed in Investing

Stop chasing performance in hopes of big returns or sacrificing gains in exchanges for safety.

Market Unpredictability

Market chaos and media frenzy will always exist – and your brain will always want to react.

Creator & Instructor

Shelley Seagler

As our Director of Education, Shelley brings over 25 years of experience in group training and facilitation. In 2005, Shelley was handpicked by our founder, Kim Snider, to take over all aspects of Snider Method education.

As the instructor of our Snider Method workshop and the creator of our Snider Method Online Course, she has taught thousands of people how to competently manage their investments.

Our clients connect with Shelley’s unique ability to take complex topics and teach them in a way even the most novice investor can understand.

About Us

Snider Advisors is a boutique, SEC-registered investment advisor. As professional covered call advisors, we have a fiduciary responsibility to our clients and a verifiable track record since 2002.

We have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. While we professionally manage approximately $75 million for clients, the Snider Investment Method, the powerful system thousands have learned to use and trust, accounts for over $100+ million in client-managed assets.

Unlike most advisors, we don’t manage money behind closed doors – instead, clients appreciate the transparency and education we provide, making them highly informed and confident investors. As a matter of fact, we use the same method to manage client assets that we teach clients to use to successfully manage their portfolios.