Start Selling Options

Covered Calls 101

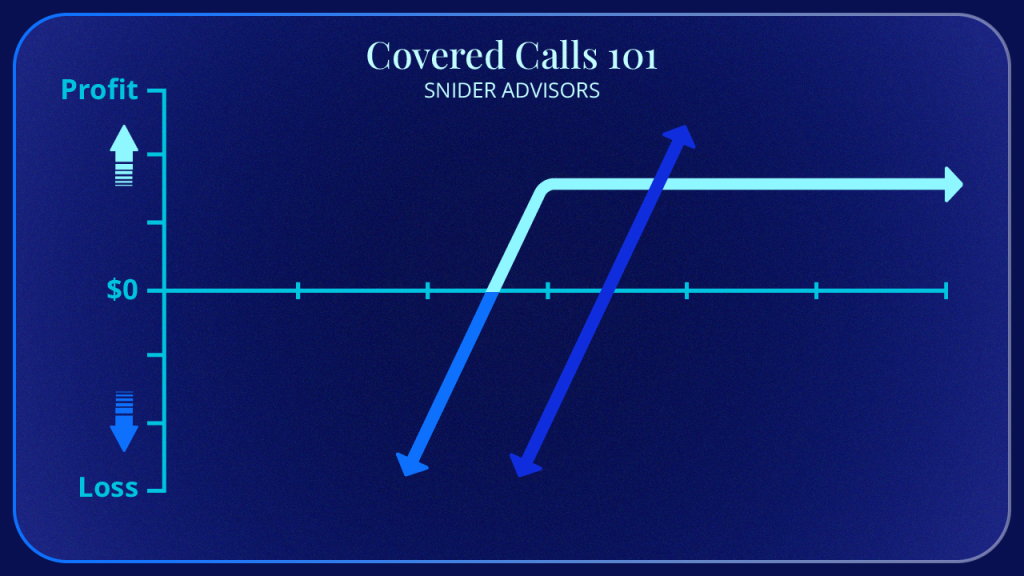

Covered call options can be used to generate portfolio income and hedge stock risk. This online course demonstrates how you can use covered calls as part of your investment strategy.

Generate Income and Reduce Risk

How to Use Covered Call Options for Portfolio Income

For income-focused investors, covered calls can be exceptionally powerful. They are considered one of the most conservative and useful trades available. It is important to understand how you can use covered calls to generate portfolio income.

In this online course, you will get a comprehensive look at covered calls. Not only will you learn the basic definitions and elements of covered calls, but you will also see a detailed example. Finally, you will learn the benefits, risks, and obligations of this strategy.

Course Overview

What is a Covered Call Option?

Covered call options are among the most popular option trading strategies available. They can be an effective way to generate income, enhance returns, and hedge the risk of stock ownership.

With a covered call, you must first own shares of a stock. You will then write (or sell) a call option against the shares you already own. In other words, you are “covering” your shares. The buyer of your covered call has the right to buy your shares from you at an agreed upon strike price on or before the option’s expiration. For this right, the call buyer will pay the call seller option premium. You, as the call seller, are obligated to sell your shares if the call buyer decided to exercise their buy your shares.

Although a covered call is a relatively simple and straightforward option strategy, there are multiple moving pieces that you should understand. For example, determining which strike price to sell your calls at is a crucial decision. The strike price can make the difference between a stock position resulting in profit or a loss.

If you’re new to covered calls, our free online Covered Calls 101 course will help you get started. It covers must-know topics like basic option vocabulary, the components of a covered call, what strike price and expiration date we recommend, and so much more.

Creator & Instructor

Shelley Seagler

As our Director of Education, Shelley brings over 25 years of experience in group training and facilitation. In 2005, Shelley was handpicked by our founder, Kim Snider, to take over all aspects of Snider Method education.

As the instructor of our Snider Method workshop and the creator of our Snider Method Online Course, she has taught thousands of people how to competently manage their investments.

Our clients connect with Shelley’s unique ability to take complex topics and teach them in a way even the most novice investor can understand.

About Us

Snider Advisors is a boutique, SEC-registered investment advisor. As professional covered call advisors, we have a fiduciary responsibility to our clients and a verifiable track record since 2002.

We have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. While we professionally manage approximately $75 million for clients, the Snider Investment Method, the powerful system thousands have learned to use and trust, accounts for over $100+ million in client-managed assets.

Unlike most advisors, we don’t manage money behind closed doors – instead, clients appreciate the transparency and education we provide, making them highly informed and confident investors. As a matter of fact, we use the same method to manage client assets that we teach clients to use to successfully manage their portfolios.