Writing

Covered Calls

for Retirement Income

Covered calls are one of the most popular option strategies available. They can be an excellent way to generate monthly cash flow while reducing your risk of investing in the stock market.

Covered Calls

A Powerful Tool for Cash Flow

This page will take you through everything you need to know to get started writing covered calls, as well as link you to resources and articles to develop your knowledge.

Income investors can sell covered calls on a regular basis to collect premiums. Covered calls can also be used to exit an existing stock position or to achieve limited downside protection. While simpler than most option strategies, writing covered calls requires a basic understanding of options and how they work.

An Overview of Options

Many investors who are interested in covered calls have minimal experience trading options. Before diving into covered calls, it helps to understand how options work on a broad level.

An option provides the buyer with the right, but not the obligation, to buy or sell an underlying stock at a certain price before an agreed upon time. Call options provide buyers with the right to buy a stock, while put options provide the buyer with the right to sell a stock. Option buyers pay option sellers a premium in exchange for these rights. Options are sold in contracts and one contract represents 100 shares of stock.

There are many different stock option strategies with varying levels of risk. For example, a naked call is one of the riskiest strategies. When you sell a naked call, you sell a call option without owning the underlying stock. Because the underlying stock could theoretically rise to unlimited heights, there could be unlimited potential loss on the trade. However, covered calls are much safer simply because you own the underlying stock.

Want to learn more about covered calls? Watch this video for a comprehensive look at covered calls.

What is a Covered Call?

When you write (or sell) a covered call, you are selling the call buyer the right to purchase shares of stock that you own at an agreed-upon price (the strike price) within a specified time frame (the expiration date).

For example, if you owned a stock currently trading around $43 per share, you could sell a call option that expires next month and has a strike price of $45. Two things can happen:.

- If your stock stays below $45 before the call expires (next month), you keep both the stock and the option premium.

- If the stock rises above $45 before the call expires, the buyer exercises the call, buying the stock from you for $45 per share. You get the money from the sale of the stock and the premium, but you no longer own the stock.

Covered Calls Explained

A buyer has the right to exercise their option up until the expiration date. If that happens — meaning the stock is called away — the shares are automatically delivered to the buyer. Options typically expire on the third Friday of every month.

Generally, when you buy a call option, you need the share price to move higher in order to make money and you also need it to happen within a relatively short time-frame. With each day that passes, options decay in value, which is bad for the buyer (but great for the seller). This makes call options a great choice for sellers looking to make a profit off stocks they already own.

To learn more about using covered calls to generate income, read How to Write Covered Calls with Better Yields.

How to Write Covered Calls

Here are the steps involved in selling covered call:

- Choose a Stock: Most investors prefer to buy stock in companies that they’re comfortable owning over the long-term. That is, they should have strong fundamentals and predictable volatility. The entire stock portfolio should also be diversified to minimize risk and maximize income.

- Choose the Expiration: Most covered call investors use rolling monthly options because of their liquidity and rate of return per unit of time. While Weeklies® provide greater income potential, monthly options are a good balance between risk, return and time commitments when it comes to setting up trades. To learn more about this concept, read Weekly vs. Monthly Covered Calls.

- Choose the Strike Price: Most covered call investors use slightly out-of-the-money strike prices to minimize the risk of an option being called away while maximizing the premium income. However, it’s equally important to consider the volatility of the underlying stock when choosing the right strike price.

In addition to these three steps, you should also consider factors like earnings and dividends. Earnings dates can significantly increase volatility (and option premiums) while dividends can influence decisions to unexpectedly call away an option. There may also be sector-specific events to consider, such as new regulations or regulatory approvals, that can significantly influence the volatility and risks associated with a stock. To take a deep dive, we recommend Should You Trade Covered Calls around Earnings and The Impact of Dividends on Covered Calls.

Keep in mind that each call gives the owner the right to buy 100 shares of a stock or to sell 100 shares of a stock they already own. If you write two calls, that would be 200 shares, for instance. Make sure you own enough shares of a stock to write a call or consider buying more. Never buy a stock that you don’t want to own, as there is no guarantee it will be called away. Remember, if you don’t own the stock, then the call sale is “Naked”, and this strategy is significantly riskier.

Make sure you own enough shares of a stock to write a call or consider buying more. Never buy a stock that you don’t want to own, as there is no guarantee it will be called away. Remember, if you don’t own the stock, then the call sale is “Naked”, and this strategy is significantly riskier.

Choosing a Brokerage Firm for Covered Calls

There is a difference between how stock and options are traded, and it is important to have your account set up with a good brokerage firm. When you trade options you will be required to sign a special agreement with your broker saying that you understand the extra risks, and understand that option trades will be subject to a different fee schedule than stocks.

There are five key characteristics to look for when selecting an options broker:

- Low Fees & Minimums

- Specialization in Options

- Great Customer Service

- Reputation & Stability

- Trade Execution Quality

We recommend TradeStation* for our clients due to their low cost, great options trading platform, and excellent customer service. While it’s one of the newer companies in the space, it offers steep discounts for active traders as well as 24/7 customer service for all clients. You may also consider using your existing broker to keep everything under one roof, but it’s important to ensure that they have competitive option trading tools and commissions.

See How to Select a Broker for Covered Calls for more information on how to select the best options broker to get started on the right foot.

*Snider Advisors has an economic incentive for recommending that clients open an account with TradeStation. Specifically, Snider Advisors receives a flat referral payment for each new relationship it refers to them. More detailed information about the relationship and our fiduciary responsibility can be found in our ADV Part 2A. Clients may contact Snider Advisors with any questions about the terms of the Agreement with TradeStation.

How to Screen for Covered Call Opportunities

Covered calls are slightly more complicated than stocks when it comes to screening for opportunities. Rather than just predicting long-term price direction, you’re predicting both the direction of the price and how volatile the price will be over a specific period. The goal is to generate an income from the premium payments rather than a profit on the underlying stock.

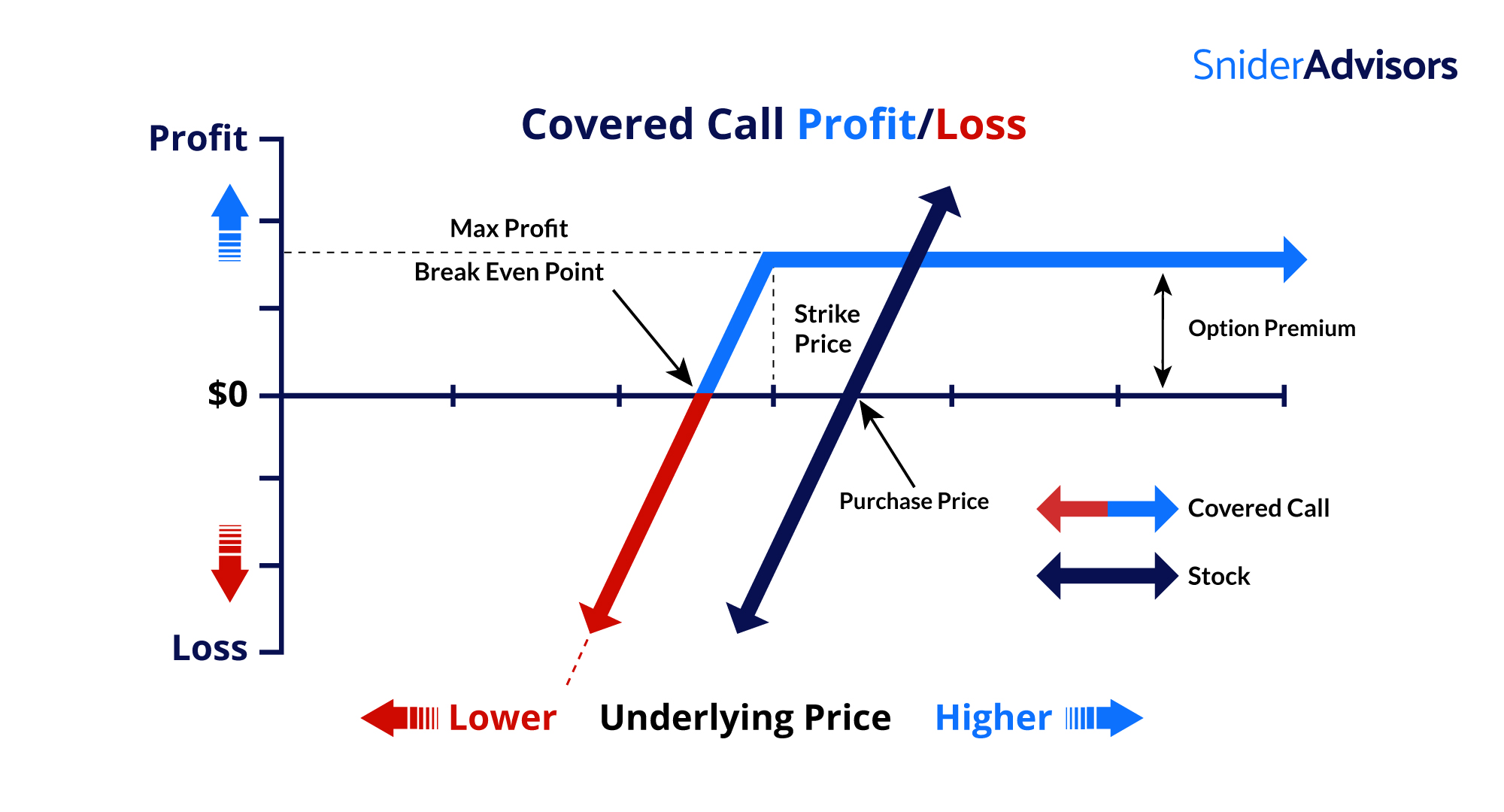

The potential risk and return for a covered call is typically expressed using a chart that shows the profit/loss on the Y-axis and the stock price at expiration on the X-axis. One line is drawn to show the stock price (diagonally) and another line shows the covered call position value at each stock price point at expiration. That way, you can quickly visualize your break-even point, max loss, max profit and other factors that influence your investment decision.

Here’s an example of this profit/loss diagram:

The three most important calculations are:

- Max Profit = Call Premium + (Strike Price – Stock Price)

- Break-even = Stock Price – Call Premium

- Max Loss = Call Premium – Stock Price

It’s important to understand these profit-and-loss dynamics and compare them to your belief in where the underlying stock is headed before entering a covered call position.

See How to Calculate Covered Call Outcomes for a more detailed look at making these calculations and determining all of the possible outcomes.

Screening for covered call opportunities involves steps that can be simplified with the use of screeners and other tools. While some covered call screeners sort by potential returns, it’s equally important to consider the risks involved before placing a trade.

See How to Find Covered Call Opportunities for an in-depth look at each of these criteria, as well as How to Choose the Right Covered Call Expirations for a comparison of weeklies and monthlies. You can also use optionDash, a free covered call screener, to find opportunities sorted by potential return and other factors.

Common Covered Call Mistakes

Here is a harsh truth: Not all investors succeed at creating a profitable portfolio. Sometimes this is due to the unpredictability in the market or various other factors, but more often new investors fail because they lack a solid investment strategy. In short, they don’t know how to navigate the pitfalls of the market. Keep reading to avoid these common covered call mistakes.

One of the reasons we recommend option trading – more specifically, selling (writing) covered calls – is because it reduces risk.

It’s possible to profit whether stocks are going up, down or sideways, and you have the flexibility to cut losses, protect your capital and control your stock without a huge cash investment.

But new investors still need to proceed with caution. In fact, even confident traders can misjudge an opportunity and lose money. That’s why we’ve assembled a list of the 5 most common errors in option trading. If you can avoid these mistakes, you stand a much better chance of success.

Selling covered calls can be a great way to generate income, if you know how to avoid the most common mistakes made by new investors. Read 5 Mistakes to Avoid When Selling Covered Calls to take a deep dive into each of these mistakes.

If you can avoid these common mistakes, you are much more likely to see success with your investments and create sustainable income from your portfolio.

Are Covered Calls a Good Strategy in a Bear Market?

You may be wondering if covered calls can be used in all market conditions – specifically, a bear market. Bear markets can be a painful experience for long-term investors—particularly those that are approaching retirement. While studies have shown that it’s impossible to accurately predict the time or severity of a bear market, there are several ways to insulate your portfolio from the decline without making drastic changes like selling everything and moving into cash.

Rather than trying to predict a bear market, most experts recommend staying in the market with a diversified portfolio that’s aligned with your investment goals. Studies have repeatedly shown that time in the market is much more important than timing the market.

The good news is that stock options can help you remain in the market but insulate your portfolio from some of the losses during a bear market. By selling call options against a long equity portfolio (creating a covered call position), you can generate an income that offsets some of your losses, complements any gains up to the strike price, or simply generates a cash income.

Covered calls are a relatively straightforward and conservative strategy, but there are still many different decisions that you must make: You must choose the right equities, select the right options, and manage the covered call position over time.

Here are some important tips for a bear market:

- For Greatest Downside Protection, Focus on In-the-Money Calls: In-the-money call options reduce income potential and limit capital gains, but they provide much greater downside protection. This is often a desirable trade off when you expect a bear market.

- Maintain a High-Quality Portfolio: Make sure that your underlying equity portfolio consists of high-quality companies—don’t purchase a low-quality stock just to capture potential income from a covered call position.

- Consider a Protective Put: Long-term protective puts can be used in conjunction with short-term covered calls to provide absolute downside protection. In some cases, the covered call income can offset the cost of a protective put.

- Don’t Feel Compelled to Trade: Bear markets can be very volatile at times and it’s okay to wait on the sidelines if you’re not comfortable trading. Don’t feel like you have to be creating covered calls every single month.

In addition to adding covered calls to an existing portfolio, you may also want to consider building a portfolio around a covered call strategy. Click here to read Are Covered Calls a Good Strategy in a Bear Market?

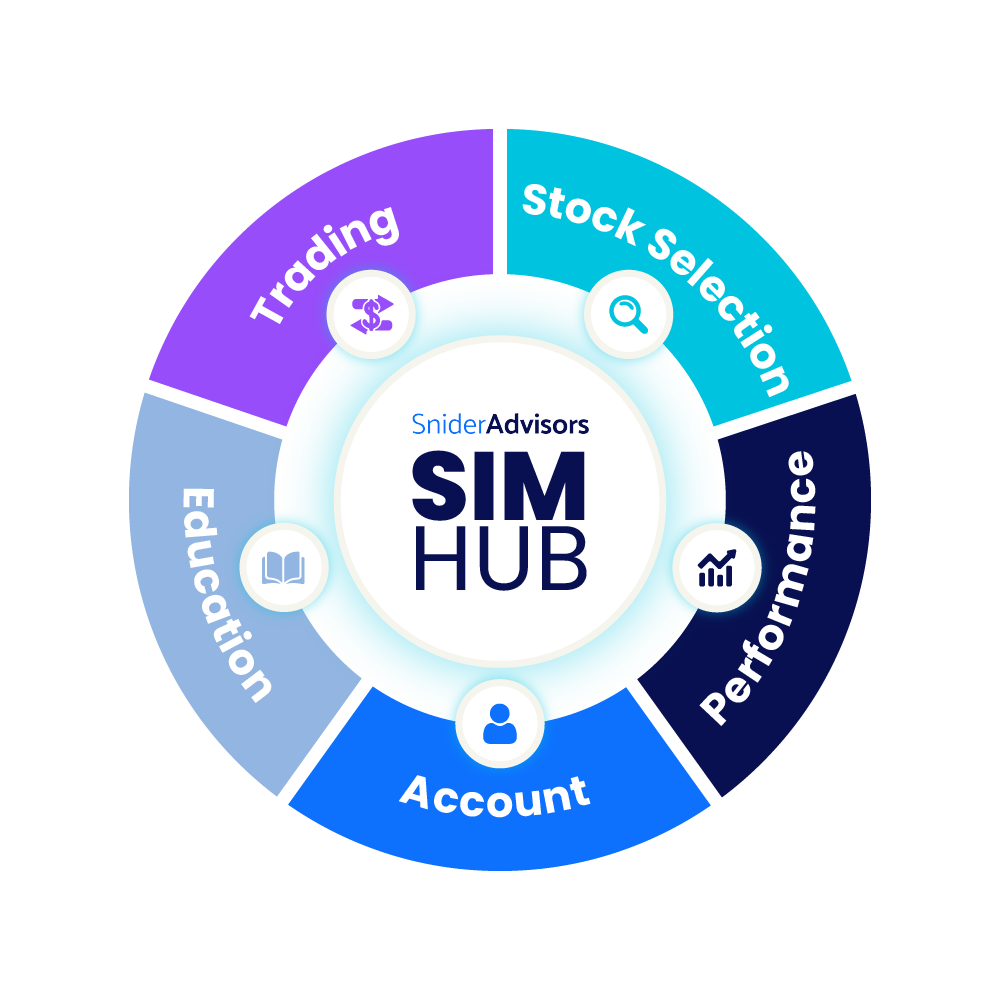

The Snider Investment Method aims to provide a reliable income from covered call options in all types of markets. We help you find fundamentally sound companies that you would be willing to own over the long-term—even if the price drops in a bear market—based on their covered call income merits and generate a monthly cash flow as close to one percent of the total investment as possible.

Covered Calls or Cash-Secured Puts?

As you learn more about covered calls, you may be curious about other option strategies as well.

Income investing with puts involve an investor selling a put option – or a right to sell – without any underlying asset. If you have the funds to purchase the shares if assigned, this is called a covered or cash-secured put. For example, an investor may sell a put option on Pear Inc. currently trading at $160.00 with a strike price of $150.00 in exchange for a $0.80 premium. The investor receives an immediate $80 in premiums that they can book as a profit in exchange for the possibility of having to buy 100 shares Pear stock at $150.00 per share.

The two possible outcomes for the trade are:

- The stock trades above $150.00 by expiration and the investor keeps the $80 in premiums as a profit.

- The stock trades below $150.00 by expiration and the investor must purchase 100 shares of stock at $150.00. The investor still keeps the premium received for selling the put.

So, which type of trade is better?

Most investors begin with covered calls since they provide monthly income with a relatively low risk, but that doesn’t mean that selling puts is a bad strategy. When deciding between put and call options, you should consider the expected direction of price movement, their goals with the underlying asset, and their risk tolerance, among other things. The key is ensuring that they’ve designed a trade that accomplishes their goals while remaining within their risk tolerance.

To learn more, read our article, Calls vs. Puts: Which Is the Better for Generating Income?

Managing Covered Call Positions

Writing covered calls is an active trading strategy that requires regular follow-up. In addition to setting up new positions every month, you may be faced with important decisions mid-month, such as whether to buy back or deliver stock if an option is called by the option buyer. To make the optimal decision, it’s important to understand all the choices available to you as well as the pros and cons of each choice.

Suppose that you have a covered call position that’s at risk of being called away because the stock price is rapidly moving towards the strike price or there is an upcoming dividend. In this case, you have several ways that you could react, and each has its own pros and cons to carefully consider.

The three primary choices are:

- You could take no action and let the stock be called away. The benefit of this strategy is that you receive cash from the stock sale and don’t incur any other costs, but the downside is that you may be taxed on the capital gains income.

- You could close out or unwind the position by buying back the covered call and either keeping or selling the stock. The benefit of this strategy is that you don’t necessarily have to sell the stock, but the downside is that you could lose money on the option trade.

- You could roll out the position by buying back the covered call and selling a new call at a later date, higher strike price, or both. The benefit of this approach is that you don’t have to sell the stock and you can minimize your losses on the option trade, but the downside is that you’re committed to a new option position right away. Click here to read, When Should You Roll a Covered Call?

The right decision depends on whether you would like to keep the underlying stock and/or if you want to realize any taxable gains or losses for the year on the underlying stock. It’s important to have a strategy in place to answer these questions beforehand in order to avoid making costly mistakes in the heat of the moment.

See Tips for Managing Covered Call Positions for more information on how to make these kinds of decisions.

Investment Education, Advanced Trading Technology, and First-Class Support.

Thousands of Investors Educated

$120+ Million in AutoPilot & $75+ Million in Managed Assets