Automation has become increasingly popular within the investment community. For example, Weathfront, Betterment, and other robo-advisors have automated portfolio management. Meanwhile, a growing number of other tools make it possible to automate your trading strategies rather than relying on third-party investment managers.

In this article, you’ll learn why you should automate your covered call strategies and different strategies for implementing an automated system.

What Are Covered Calls?

Covered calls are a popular options strategy for income-focused investors. If you have a neutral or slightly bullish outlook on a stock, you can sell or “write” a call option that gives someone else the right to buy the stock at a predetermined price, known as the strike price, before a specific expiration date.

As the seller of the option, you earn a premium from the buyer, which provides an income stream and a degree of downside protection. However, you also limit your upside potential since you’re obliged to sell it at the agreed-upon price – even if it rises significantly above the strike price.

The goal of any covered call strategy is to make more from a premium than you give up if the underlying stock price increases. While it’s easy enough to calculate the expected payoff, you must also estimate the variance of the payoff by creating a probability distribution for the share price over time.

In addition to these calculations, you may also want to factor in upcoming events like an earnings announcement that could introduce volatility. Other factors like an ex-dividend date or special dividend could influence whether or not the option buyer will likely exercise the option.

Why Automate Covered Calls

Automated trading tools have become increasingly common over the past decade. While early platforms required extensive coding knowledge (e.g., Interactive Brokers), newer platforms made it easy for anyone to use automation to improve their performance. Collective2 and others even let you copy other traders with verifiable track records.

While many platforms focus on applying technical analysis to stocks and futures, some can help automate option strategies like covered calls. In addition to identifying suitable stocks, they can monitor the market and manage risk based on real-time events. That way, you can systematically generate income and remove emotion from decision-making.

There are several reasons to consider automation:

- Time Efficiency – Algorithms and AI can handle the tedious task of monitoring the market, executing trades, and managing positions. In addition to saving time, these algorithms can monitor the market 24/7, eliminating the need for you to watch the market constantly.

- Risk Management – Automated tools automatically adjust positions to stay within defined risk parameters. By removing emotion from trading decisions, you can reduce the possibility of unnecessary losses from recency bias or sunk cost fallacies.

- Scalability – Automated trading systems can simultaneously monitor hundreds of stocks and manage even the largest portfolios, making them more scalable than a do-it-yourself approach.

- Consistency – Automated trading systems leverage pre-set rules to execute strategies to the letter. As a result, they produce much more consistent results than human traders, which may change their minds or alter their approach depending on the situation.

- Backtesting – Automated trading systems enable you to backtest strategies using historical data since they apply the same rules every time. Before implementing your strategy, you can see how it would have performed under different market conditions.

How to Automate Covered Calls

Many traders automate covered call trading strategies using programming languages like Python and brokers supporting programmatic trading like TDAmeritrade. For example, Andrew Madigan has a popular project where he discusses how he built a covered call trading system and even provides his source code on GitHub.

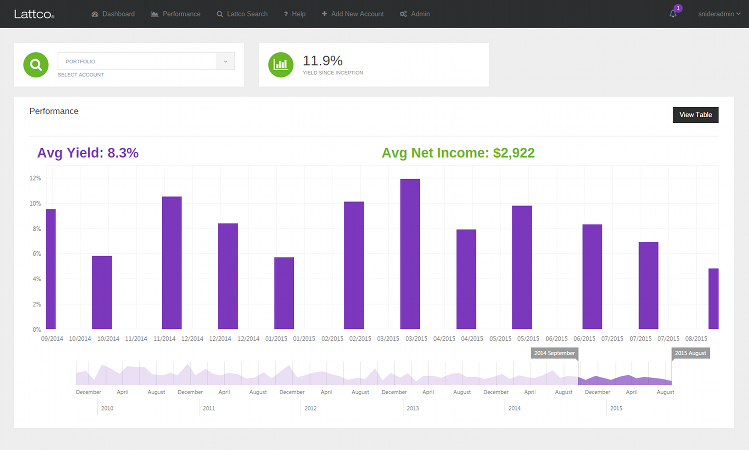

While these options are great for experienced programmers, Lattco’s AutoPilot is the easiest way for non-technical traders and investors to automate covered call strategies. Built from the ground up for covered calls, the platform leverages the Snider Investment Method to select and manage covered calls.

The Snider Investment Method answers many of the common questions and problems that arise in a systematic way, such as:

- What stocks are best for covered calls?

- What strike price and expiration date should you use?

- How much should you allocate to a particular stock?

- What do you do if the stock rises in price?

- What do you do if the stock falls in price?

- How many options contracts should you sell?

Meanwhile, the Lattco AutoPilot platform provides several unique features to help you boost income and reduce errors, including:

- Limit Orders – The platform automatically generates a limit order form when an option order has the potential for added income and suggests a modification if the order doesn’t execute immediately.

- Bundles – The platform automatically scours option chains and your available shares to sell every profitable bundle, ensuring you never miss a covered call opportunity.

- Wizard – The platform’s comprehensive wizard walks you through every trade for all your positions while pre-filling the symbols and quantities you need for each transaction.

Potential Pitfalls of Automation

Automation can help reduce human error and produce more consistent trading results, but there are some pitfalls to consider. By considering these pitfalls, you can be aware of potential problems with automated trading platforms and avoid problems when building your own trading systems.

The most common pitfalls include:

- Over-optimization – Many trading system developers fine-tune a strategy using historical data as a guide. However, an overly-specific trading strategy may not be flexible enough to adapt to changing market conditions. As a result, it may perform well with past data and poorly with new, live data.

- Technological Failures – Automated trading relies heavily on technology, from the algorithm to the internet connection. A faulty algorithm could lead to unintended trades or missed opportunities, while a bad internet connection could disrupt the system, causing missed trading signals.

- Liquidity Risks – Many automated strategies fail to account for liquidity. For example, during periods of unusually high volatility, markets may be less liquid than normal. And that could cause differences between expected and actual performance.

The Bottom Line

Automation has become increasingly popular among investors. While robo-advisors and programmatic trading systems dominate automation, platforms like Lattco AutoPilot can help you automate covered calls, boosting income and reducing risk.

If you’re interested in covered calls, take our free e-course to learn more, or sign up with Lattco AutoPilot today. If you’d like to take an even more hands-off approach, contact us to learn more about our asset management services.