Retirement-focused investors are always looking for ways to boost their cash flow. While bonds and dividend stocks are long-standing go-to options, savvy investors are increasingly turning to the options market to provide an income boost.

While options trading may seem intimidating with its complicated jargon and stricter trading requirements, it has become more accessible in recent years. This accessibility, coupled with the potential to boost income, has sparked growing interest in strategies to supplement or even replace traditional investment income sources.

In this article, you’ll learn how to leverage options to create robust cash flow while being cognizant of risk.

Generating Investment Income

Most investors are familiar with traditional investment income sources like dividend stocks and bonds. These tried-and-true methods have been the backbone of retirement income for generations. Dividend paying stocks offer a regular share of their profits, while bonds provide steady, predictable income in the form of interest on a loan.

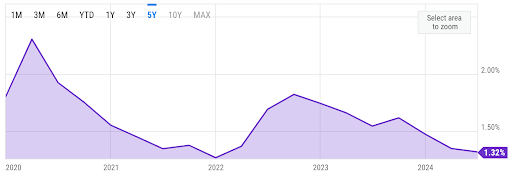

The S&P 500’s dividend yield has fallen over time. Source: YCharts

But, with interest rates falling again, these traditional sources might not yield as much as you’d hope. The S&P 500 index’s dividend yield fell from 1.8% in mid-2022 to just 1.3% by mid-2024, reflecting a long-term trend lowering dividends. Meanwhile, the 10-year Treasury yield fell from a high of nearly 5% last year to about 4% today.

This is where options come in. Think of options as a dynamic way to put your money to work. Rather than passively waiting for dividends or interest payments, options allow you to actively generate income from your portfolio. And, best of all, you can layer these strategies on other income strategies like dividends to get the best of both worlds!

Options strategies may yield a lot more than traditional investment income sources. For example, the JPMorgan Equity Premium Income ETF (JEPI) yields an enviable eight percent! But, of course, options come with increased risk and complexity. So, you’ll need to roll up your sleeves before diving into this powerful way to boost your income.

Option Strategies for Income

Now that you’re ready to dive into the world of options, let’s explore some specific strategies that you can use to boost your cash flow. Rather than trying to find the “best” strategy, think of these as different tools in your investment toolbox—each with its own purpose and best use case in each situation.

Covered Calls

Imagine you own a vacation home that you rent out occasionally. Covered call writing is similar—you’re making extra money from stocks you already own.

Here’s how it works:

- You sell someone the right to buy your stock at a specific price (the strike price) within a certain timeframe (the expiration date).

- You collect money upfront (a premium) for selling this right.

- If the stock price stays below the agreed price, you keep your stock and the premium. If it moves higher, you sell the stock at the agreed price.

But there are two big trade-offs:

- You’re still on the hook for any drop in the stock’s value, although any losses are partially offset by the premium you receive.

- You sacrifice any potential upside above the strike price, which can result in significant opportunity costs.

While more volatile stocks pay a higher premium, the best opportunities balance income potential with the likelihood that the option buyer exercises their right. After all, selling a stock involves incurring a taxable capital gain and paying to buy back the option can result in a net loss on the effort (although partially offset by the rise in the stock price).

Cash Secured Puts

Cash-secured puts are like getting paid to promise to buy a stock you want at a discount. You’re essentially saying, “I’ll buy this stock if it drops to $X price, and being paid for making that promise.” It’s a great way to generate income while waiting to buy stocks that you already want to own at more favorable prices.

Here’s how it works:

- You sell someone the right to sell you a stock at a specific price (the strike price) within a certain timeframe (the expiration date).

- You collect money upfront (a premium) for selling this right.

- If the stock price stays above the strike price, you keep the premium and don’t have to purchase the stock. If the stock price falls below the strike price, you keep the premium and purchase the stock at the agreed price.

But there are some risks:

- You could miss out on the stock’s upside potential if it fails to reach the strike price, and you never purchase it before the move higher.

- The agreed price might be higher than the market price for a stock that moves sharply lower before the option is exercised.

As with covered calls, volatile stocks usually offer more income potential, but they also involve more risk. The best opportunities are strong companies that you’d like to own at or below the strike price—knowing that you may pay more than the market price.

Credit Spreads

Credit spreads are a bit more complex than covered calls or cash-secured puts, but they can be very effective for income generation. Put simply, you use one option to generate income and the other to limit your overall risk.

Here are two examples of credit spreads:

- Bull Put Spreads – You’re betting the stock won’t fall below a certain price by selling one put option at a higher strike price and buying another put option at a lower strike price.

- Bear Call Spreads – You’re betting the stock won’t rise above a certain price by selling one call option at a lower strike price and buying another call option at a higher strike price.

In both cases, you should receive more income from selling the first option than you pay buying the second option—known as a net credit. You keep this amount as income but could end up losing money if the stock moves above or below the initial strike price.

Iron Condors

The final strategy we’ll cover combines a bull put spread and a bear call spread to bet on the stock staying within a certain range. If you believe a stock will trade sideways for a while, it’s an effective strategy to generate some extra income.

You can create an iron condor by selling an out-of-the-money call option and an out-of-the-money put option while simultaneously buying a further out-of-the-money call option and a further out-of-the-money put option.

Trade-Offs & Considerations

Options trading may offer higher income potential than traditional sources, but you should carefully weigh these benefits against the risks. Each strategy presents a unique balance of risk and reward. And some strategies—like the iron condor—are more complex than others. On the other hand, covered calls remain one of the most popular and simplest option strategies.

Implementing these option strategies may involve more capital and active management than simply collecting dividends or interest. For example, you need at least 100 shares of a stock to sell a call option against it. And if there’s an unexpected price movement, you may need to act quickly to roll up or roll out the position.

Of course, there’s also a steeper learning curve. The new language may be easy to pick up in a few weeks, but knowing how to react when your trade goes awry or selecting the right strike prices or expiration dates can be difficult. The good news is that there are plenty of places to learn, including Snider Advisors’ free e-courses covering the basics.

And finally, options trading may impact your tax obligations. Most income generated by options falls under the short-term capital gains category, which may involve a higher tax rate than qualified dividends or municipal bonds. So, it’s a good idea to consult with your accountant or tax professional before changing course and using options.

The Bottom Line

Options strategies offer an innovative way to level up your investment income. While they involve more active management and carry their own set of risks, they offer a powerful tool to maximize cash flow and supplement your retirement income.

If you’re just getting started with options for income, Snider Advisors can help you get started with a done-for-you strategy that we call the Snider Investment Method. Or if you’d like to take a more hands-off approach, contact us to learn more about our asset management services.