Choosing the right expiration dates for covered calls is essential to maximize profits and manage risk. While there’s no right answer for everyone, taking the time to understand the pros and cons of different expiration dates can help you balance premium income against potential stock appreciation or the risk of the stock moving lower.

In this short guide, you’ll learn how expiration dates impact option profitability, the trade-offs between short- and long-dated options, and how to choose the best option for your situation.

A Brief Covered Call Primer

Covered calls involve selling call options on stocks that you already own. By doing so, you can earn a premium from a buyer who’s paying for the right to purchase the stock at a specified price (strike price) on or before a certain date (expiration date).

There are several reasons you might sell covered calls:

- Income Generation – You can sell covered calls to generate income above and beyond any dividends from the stock. And, if you don’t expect the stock price to rise much, it’s an excellent way to boost your overall returns.

- Downside Protection – The premium you receive from selling a covered call can provide limited protection against a decline in the stock price. However, if the stock price falls significantly, you might be better off selling the position.

Of course, there’s no free lunch in the financial markets. By selling covered calls, you cap the upside potential on the stock since you are agreeing to sell it beyond a certain price. These opportunity costs can quickly add up when you miss out on major market moves.

The key to success is investing in the right stock and options. For instance, a neutral to moderately bullish market outlook can help minimize the odds that your options are called away while the right options can provide a source of reliable income.

The Impact of Expiration Dates

The expiration date of a call option has a significant impact on its valuation. Not surprisingly, options with less time until expiration are worth less than those with more time until expiration. These dynamics are represented by the option Greek theta, or time decay, which measures how much the option’s value will decline every day up to maturity.

For example, if a stock is trading at $100 and the 100 strike call options have 0.10 thetas, then the option contract would decay approximately $0.10 per day. Meanwhile, an option with a further expiration date or a further out-of-the-money strike price may have a lower theta since these options have less time premium in the first place.

Implied volatility also plays a role in time decay. Generally, higher levels of implied volatility lead to higher theta. However, options may also trade with a higher implied volatility because of an earnings announcement or other upcoming event. So, you cannot always sell options higher in implied volatility and expect to earn an immediate theta.

Finally, it’s important to note that theta is not linear. The theoretical rate of decay will tend to increase as time to expiration decreases. As a result, the amount of theta is usually gradual at first and accelerates as the expiration date approaches. Upon expiration, an option has no time value and only trades at its intrinsic value.

How to Decide on the Best Expiration

The first step in choosing an expiration date is determining how much time you can commit to trading covered call positions. If you only want to check your portfolio a few times per year, you may want to stick with 90-day to six-month expiration dates. That way, you don’t have to constantly monitor the market to enter and exit positions. When selling calls, shorter timeframes are to your advantage. This is due to the fact that time decay increases approaching expiration. Time decay is an advantage to option sellers.

If you have more time to commit, you might consider 30- to 45-day expirations. Most covered call investors prefer rolling monthly options due to their liquidity and rate of return per unit of time. While you could also choose Weeklies®, they involve a lot more time to manage and may have less liquidity which leads to more slippage and higher spreads.

Where to Find the Best Opportunities

The next step is finding the best opportunities within your chosen timeframe. For instance, if you’re willing to look at 30- to 45-day expirations, you would input these restrictions into your option screener and then seek out the best opportunities within that range. Generally, this means finding acceptable premiums at your chosen strike price.

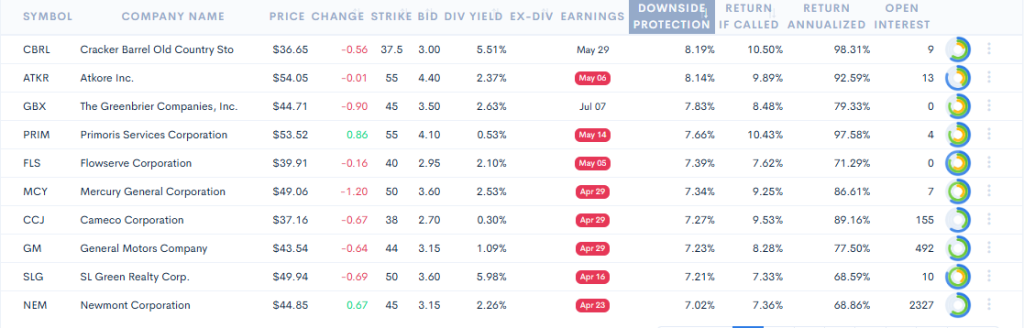

Option screeners are an essential part of the process. For instance, optionDash provides an easy-to-use platform to find covered call opportunities. After choosing a price range for the stock and expiration date, you can search through thousands of stocks to find the best opportunities ranked by everything from income potential to potential risk.

optionDash makes it easy to find the best opportunities for a given expiration. Source: optionDash

For beginners, a good starting point is looking for 2% of the stock’s value as an acceptable premium. Using this strategy, you might look for an expiration date and strike price that offers a $2 premium if the underlying stock is $100 per share. But, of course, your specific targets depend on your risk tolerance and return requirements.

You might also take into account other factors. For example, you might prefer out-of-the-money options if you want to reduce the risk of having to deliver the stock or roll a position. Or, you may seek maximum downside protection to lower your overall portfolio risk (e.g., minimizing the chances of an absolute loss in value after accounting for capital gains and losses).

Be Mindful of the Potential Trade Offs

Options have predictable behavior when you zoom out. The further you go out in time, the more an option will be worth because there’s more time for the price to move higher. However, the further you go out into the future, the harder it is to predict what might happen. There are more opportunities for unexpected good news or earnings announcements.

If an option’s premium seems abnormally high, there’s usually a reason for it. You might want to check if there’s any news that might affect the stock or ensure that there’s not an upcoming earnings announcement that could impact the price. In other words, if it’s too good to be true, it probably is, and you should double down on your due diligence.

The Bottom Line

Covered calls are an excellent way to generate income or provide limited downside protection. When searching for the right opportunities, choosing the right expiration date is essential. By following the guidance in this article, you can avoid many of the common pitfalls and choose expiration dates that make sense for your goals and risk tolerance.

If you’re interested in covered calls, the Snider Investment Method provides a done-for-you strategy to select the right underlying stocks, strike prices, and expiration dates. The strategy also shows you how to plan for changing market conditions. It is key to have a covered call strategy that can handle unexpected changes in price.

Take our free e-course to learn more or contact us to learn more about our managed solutions.