Covered calls are an excellent way to generate extra income from a long stock portfolio. Rather than relying on stock dividends or bond interest, covered call investments generate additional income from option premiums. These income-generating options can help supplement your retirement or buffer against potential losses by lowering your cost basis.

In this guide, we’ll walk through your first covered call trade, covering everything from setting up a brokerage account to managing a trade that goes sideways.

Let’s dive in!

Setting Up a Brokerage Account

Many brokers support covered calls and other options strategies. However, each broker has different minimums, commissions and fees, and options trading features. For example, many sophisticated platforms have volume-based fees whereas simpler platforms charge a flat fee consisting of a commission and per-contract fee.

When choosing a broker, you should consider:

- Fees and commissions

- Options trading features

- Trade execution

- Customer service

We recommend TradeStation because of its $0 commissions and low $0.35 per contract fees, which is lower than Schwab, TD Ameritrade, Merrill Edge, and Fidelity. In addition, the trading platform includes option chains, profit/loss diagrams, profitability calculators, and proprietary research, along with a convenient mobile application.

If you’re an advanced trader, Interactive Brokers offers the lowest commissions and most advanced features. These fees are as low as $0.15 per contract for those trading over 100,000 contracts per month. You also have access to a strategy builder, strategy lab, profitability lab, and volatility lab to identify profitable trading strategies.

Options Trading Agreements

Trading options is inherently riskier than stocks, so regulators require some extra disclosures and brokers may ask a few more questions.

You may need to provide information about your:

- Investment objectives

- Trading experience

- Financial information

- Option strategies

Based on your responses, the broker will assign an initial trading level that determines the strategies you can use. Low-risk Level 1 accounts may qualify for basic strategies, including covered calls, whereas Level 5 accounts may qualify for naked puts and other riskier options strategies with greater potential for gains and losses.

If you’re opening a new account, you likely need to sign an options agreement and read the Characteristics and Risks of Standardized Options. Some brokers also require margin accounts for certain option transactions, like writing uncovered calls, which may involve more paperwork even though you cannot purchase options on margin.

If you already have a brokerage account, you may be able to enable options trading at your current broker. They will also require an options agreement and provide you with the Characteristics and Risks of Standardized Options. But ultimately, selecting the right Trade Level is key to protecting yourself from risky strategies. Selecting the lowest level, which will allow for covered calls, is a great way to get started.

Selecting the Right Stock

The first step in creating a covered call investment is choosing the underlying stock. But if you’re looking for a simple rule, you might be disappointed! The best optimal stock for a covered call depends on your personal strategy and goals.

Long-term investors should choose companies based on their underlying fundamentals and growth potential. For example, you might look for undervalued or growing companies with a history of predictable earnings. That way, you can write out-of-the-money covered calls that generate predictable income while benefiting from equity appreciation.

We recommend looking at a few key factors:

- Cash Flow – Companies that generate strong free cash flows are less likely to need to raise dilutive capital or run into debt problems.

- Debt Levels – Companies with modest debt-to-equity ratios are less likely to have issues raising capital or servicing their existing debt.

- Volatility – Highly volatile companies might offer higher yields, but the volatility makes it challenging to avoid assignment.

- Growth Prospects – Growing companies offer a combination of income and equity appreciation—a win-win for investors.

On the other hand, if you are purely looking to maximize yield, you might choose a stock based on the income potential of its options. For example, buy-write strategies involve simultaneously purchasing a long stock position and selling a covered call to generate yield, and you may not plan on holding the stock over the long term.

Choosing the Best Call Option

The next step is finding the right call option to sell against the long stock position. But again, there are no simple rules to follow. The right choice depends on your strategy and goals.

Many long-term investors usually prefer out-of-the-money options that minimize the risk of having to sell the stock (or buy back the option). However, some might prefer to write at-the-money or in-the-money options that limit their downside risk and maximize their income.

When choosing an expiration date, many investors prefer to write monthly call options due to their low maintenance. But some might prefer weekly—or even daily—call options to maximize income even if they need to watch the market more closely.

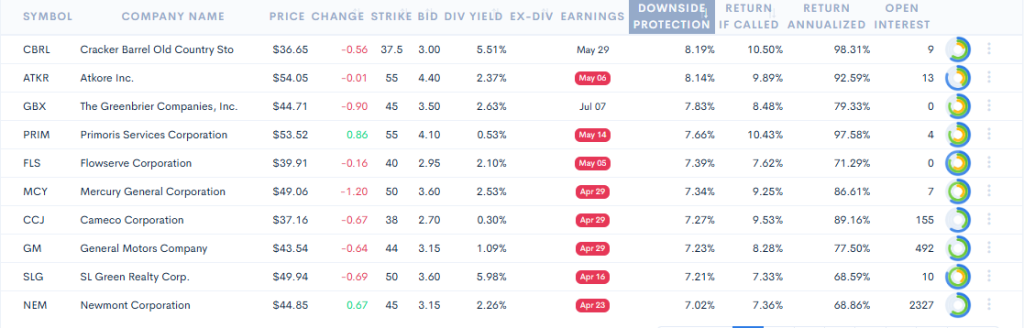

optionDash is one of the best screeners to find covered call opportunities. Source: optionDash

The good news is that covered call option screeners can help you find opportunities. For example, optionDash makes it easy to screen for options and sort opportunities by their downside protection or if-called return. You can also see upcoming earnings dates to avoid potentially volatile time periods that could result in greater assignment risk.

Managing the Covered Call Investment

The optimal payout for a covered call position involves the stock price moving just below the strike price at expiration, resulting in the most capital gains and income. But, of course, that’s not always how things play out in the real world!

A covered call investment may need adjustments throughout its lifecycle. For example, if you sold a call option against a long stock position and the stock price moves above the strike price, you may have to roll up or roll out the option to avoid assignment.

The most common adjustments include:

- Roll Up – Close out the existing call option and sell another with the same expiration date but a higher strike price.

- Roll Out – Buy to close the existing call option and sell another with the same strike price but a later expiration date.

- Roll Down – Buy to close the existing call option and sell another with the same expiration date but a lower strike price.

Depending on the situation, you could end up paying more money to keep the position alive or receiving more premium income in exchange for more time. For example, rolling out might let you avoid losing any money, but you must wait an additional month.

The Bottom Line

Covered calls are a relatively straightforward options strategy, but that doesn’t mean it’s easy money. Before making a covered call investment, you should understand the risks, find the best stock and option combination, and be ready to make adjustments along the way.

If you’d rather passively invest in covered calls, you might want to consider covered call investment services like Snider Advisors. We offer a free e-course to teach you everything you need to know or asset management services for a hands-off approach. Our trading platform, SIM Hub, can also simplify the process of finding and managing covered calls.