Many retirement investors are looking for ways to boost portfolio income while reducing downside risk. While fixed-income securities offer high yields, they don’t provide any potential for capital gains, resulting in less overall portfolio growth. And while dividend stocks provide some income, they often falls short of the yields offered by fixed income.

Covered calls have become a popular alternative. While the covered call ETFs provide the easiest solution, they don’t always contain the ideal long portfolio for your situation. So, if you’re looking for more control, you may want to implement covered calls on your own. However, doing so can quickly become overwhelming if you’re not familiar with how options work.

Let’s dive into how covered calls work, what you should look for in an expert, and why Snider Advisors might be a good fit.

Understanding Covered Calls

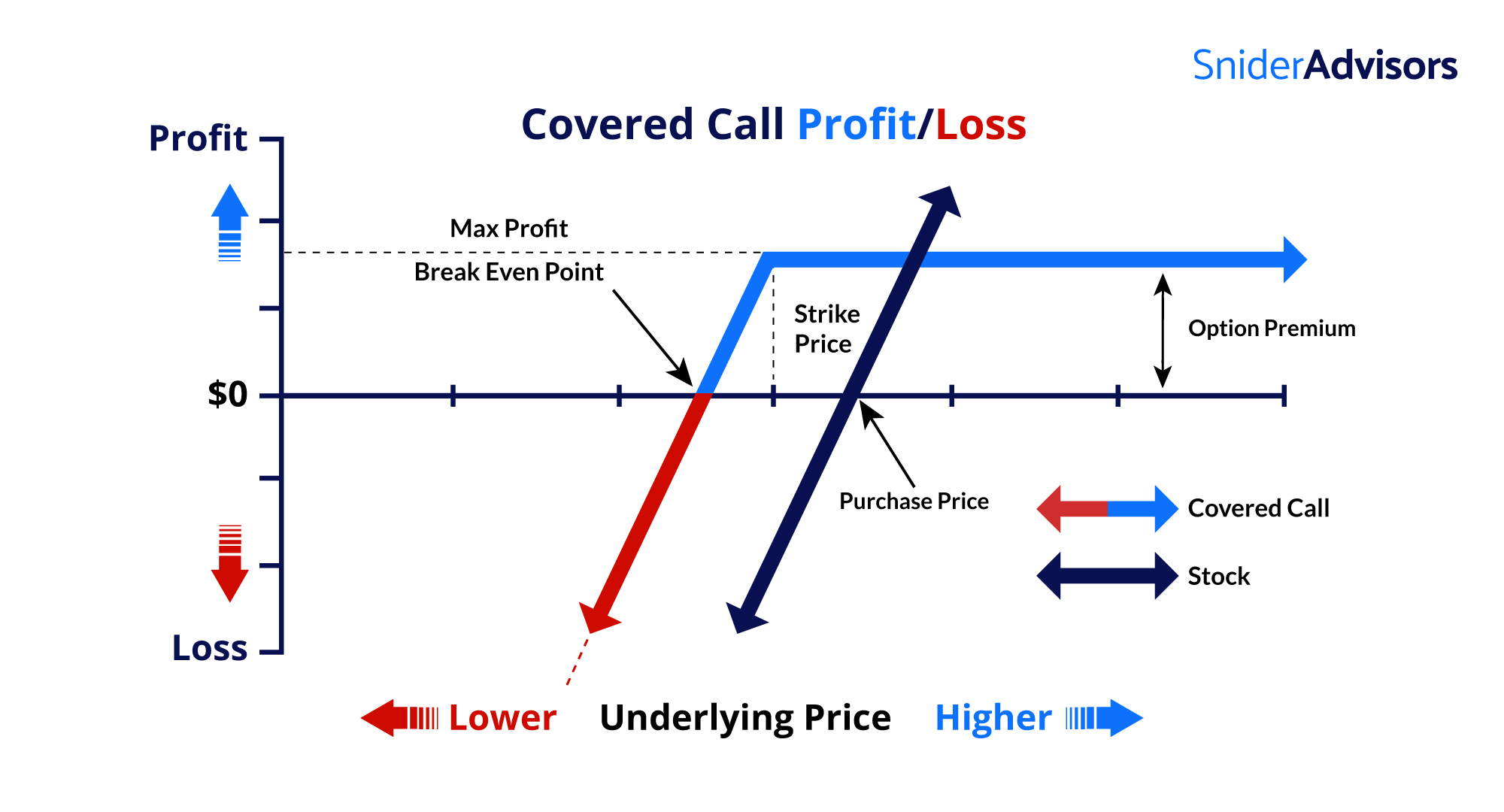

Covered calls can help you generate income from your existing stock portfolio. By selling call options on a stock that you already own, you’re agreeing to sell the shares at a specified price (the strike price) within a certain period. And in exchange, you receive an upfront option premium payment that you can keep as income.

Covered call option diagram showing the profit/loss scenarios.

Most investors use covered calls to earn additional income from their portfolio, which can help offset potential losses or enhance overall returns. However, the trade-off is that the investor limits their upside potential. If the stock rises above the strike price, the call buyer may exercise the option and require the investor to sell at the agreed-upon price.

Covered calls work best in neutral to slightly bullish markets. It’s a way to capitalize on assets that you already own without taking on significant additional risk. But it’s important to carefully select the strike price and expiration date to align with your investment goals and risk tolerance, as well as to minimize excessive opportunity costs.

The Role of a Covered Call Expert

Covered calls are relatively straightforward as far as option strategies go, but that doesn’t mean they’re easy for everyone to implement. For example, you might not know how to screen for the best covered call opportunities or handle covered call positions at risk of being called away (which could trigger capital gains taxes).

A covered call expert can provide insights into how to effectively implement the strategy to enhance portfolio income while managing risk. They help clients identify opportunities where a covered call strategy might offer desirable income without undue risk, considering the investor’s goals, risk tolerance, and market outlook.

Moreover, they can educate investors about the nuances of options trading, including potential tax implications and the importance of managing assignments and exercises effectively. This guidance can be invaluable in avoiding common pitfalls and maximizing the benefits of the strategy within a broader investment approach.

When to Hire a Call Writing Expert

Many investors lack the time or expertise to manage the complexity of option strategies themselves. For example, you might be a value investor who prefers to look at SEC filings and financial statements rather than the technicalities of options. If that’s the case, you can hire a covered call writing expert to enhance returns on your existing portfolio.

In other cases, you may want to refine your investment strategy in response to changing market conditions. Equity investors during bull markets may have locked in substantial capital gains, but long-only strategies take more work to execute in more neutral markets. If you want to boost performance, a covered call writing expert could step in to help.

And, of course, those looking to take a completely hands-off approach might hire an option income advisor to boost their performance. These financial advisors can incorporate option selling into a broader investment strategy designed to boost retirement income or provide a downside buffer to protect against market downturns.

Selecting the Right Expert

Selecting the right covered call writing expert is a crucial decision. After all, you’d never hire a financial advisor or choose a mutual fund without looking at the person’s experience, track record, and other factors. But, for covered calls, choosing the right person can be even harder because there aren’t as many experienced candidates as the stock market.

Start by looking for someone who has a proven history of using covered call strategies across different market cycles. Since the last bull market has lasted so long, this could mean looking past the 2010s at a track record. The ability to navigate both bull and bear markets could be essential with the low-interest rate era over.

Soft skills are equally important. Communication and transparency are critical to ensure the call-writing expert adheres to a risk tolerance level you’re comfortable with while helping you understand where your money is deployed. And, of course, this transparency should extend to fees and compensation, which should put your interests first.

And finally, if you’re choosing a financial advisor, be sure to background check them with FINRA’s BrokerCheck platform. That way, you can see if they have any past disciplinary actions or other red flags that you may want to avoid. You can also see how these brokers derive their compensation and spot any potential conflicts of interest.

Snider Advisors Can Help

Snider Advisors is a boutique, SEC-registered investment advisor that has specialized in covered calls since 2002. Unlike a conventional financial advisor, we teach you our proprietary Snider Investment Method to help you self-manage your portfolio for a fraction of the cost of conventional asset management.

We manage approximately $65 million in client funds using the Snider Investment Method, creating a verifiable track record extending back more than twenty years. Meanwhile, we’ve taught the method to investors managing more than $120 million in assets, showing that the process is learnable and repeatable for anyone.

Our rules-based system, easy-to-use technology tools, and by-your-side customer support provide everything you need to generate more income from your portfolio. As registered investment advisors, you can also verify our compliance with regulations on FINRA’s BrokerCheck while relying on us to help you with broader portfolio questions.

The Bottom Line

Covered calls may be one of the simplest option strategies, but that doesn’t make them easy to implement in practice. Fortunately, covered call experts can help you realize the benefits of covered calls without having to get a master’s degree in finance. The key is finding someone with the right combination of experience and communication.

If you’re interested in taking a do-it-yourself approach without starting from scratch, try taking our free e-course introducing the Snider Investment Method. You’ll learn how covered calls work and key concepts of our investment approach. Our Do-It-With-Assistance strategy removes the question marks and provides you with the tools and insights you need to succeed. Or sign up for our hands-off asset management solutions and we’ll take care of the heavy lifting for you!