Many investors fail to appreciate the substantial impact that dividends have on stock performance over time.

According to Hartford Funds, more than 80 percent of the total return of the S&P 500 index between 1960 and 2016 is attributed to the compounding of reinvested dividends. The same study found that companies that grew or initiated dividends experienced the highest return relative to other stocks since 1972 with significantly less volatility. In other words, companies that pay dividends offer the highest returns and the lowest risk!

Let’s take a closer look at how dividends impact stock performance and why investors should pay attention to total returns rather than price returns when building their portfolio.

Price Return vs. Total Return

Investors typically look at two different types of returns for stock indexes, mutual funds, exchange-traded funds (ETFs) or their own portfolios: Price return and total return.

Download our free Checklist of Dividend Strategies for Investors to learn how you can generate an income from your portfolio.

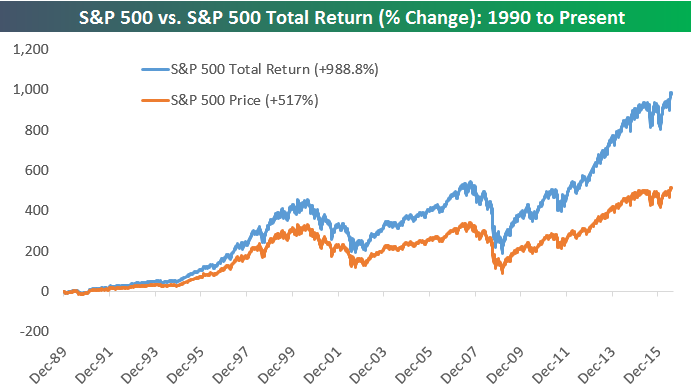

The price return typically captures the capital gain or loss without coupons or dividends. By comparison, the total return captures both the capital gains and the income generated from coupons and dividends. The latter provides a much more complete picture of performance — especially for stocks or funds that have high coupons and dividends.

Total Return vs. Price Return for the S&P 500 Index – Source: Bespoke

The catch is that the total return assumes that dividends are reinvested into the stock or fund in question.

For example, the S&P 500 index is a total return index that assumes any dividends issued by its component companies are reinvested in the overall index. If you’re not reinvesting these dividends in your portfolio, your return will differ from the total return index value over a period of time.

Different companies may also have different definitions for price versus total returns.

For instance, BlackRock’s exchange-traded funds’ (ETFs) market price return and total return both include distributions. The difference is that the total return is computed from the net asset value, or NAV, whereas the market price return is computed from a market price midpoint.

What It Means for Investors

The first takeaway is that dividends have a significant impact on a stock portfolio’s performance. Dividend-paying stocks tend to outperform non-dividend-paying stocks over time in total return. This means that investors may want to consider building a dividend-centric portfolio — especially if they’re nearing retirement and want less volatility.

The second takeaway is that investors should take the time to understand different return calculations when comparing stocks and building their portfolio.

Let’s compare two stocks to understand the difference. Image two stocks both priced at $25. Your first stock pays a $0.25 dividend each quarter. This would be a 4% dividend yield. Your other stock does not issue a dividend. Twelve months later, your dividend paying stock is trading at $24.50 and the other stock is still priced at $25. Even though your dividend payer declined in price, it still outperformed the other stock because you collected $1.00 over the course of the previous 12 months. Many investors just look at the movement in price when comparing two stocks and forget about factoring in the dividend payments as well.

Total returns, or returns by other names, that include distributions, coupons, and dividends are much better for comparison than price returns, or returns by other names, that only look at the capital gain or loss from the NAV or market price. This is especially true when comparing stocks that pay a high dividend with growth stocks that offer no dividend.

Investors should also be mindful when making assumptions using a total return index performance since these returns depend on dividend reinvestment. When projecting capital gains or losses for a portfolio, you may need to adjust them depending on whether you plan to withdraw dividends to fund retirement or reinvest them in the fund for long-term growth.

Finally, it’s important to take these factors into consideration for benchmark indexes. For instance, if you’re benchmarking performance against the S&P 500 index, you must ensure that your performance metrics assume that you’re reinvesting any dividends back into the portfolio. Otherwise, you may need to adjust or select a new benchmark index.

Dividend Reinvestment Plans (DRIPs)

Many mutual funds make it easy to reinvest dividends, but individual stocks make the process a bit more challenging. The good news is that every public company wants investors to reinvest this capital to improve their price and liquidity, so some have introduced dividend reinvestment plans, or DRIPs, to make it easy.

Don’t forget to download our free Checklist of Dividend Strategies for Investors to help generate a consistent portfolio income.

Automatic DRIP plans are programs offered by brokerages to enable investors to have their dividends automatically used to purchase additional shares of the issuing security. While the practice has been widely used among mutual funds and blue chip stocks, it’s relatively new for ETF issuers and may not be available for smaller stocks.

In cases where DRIPs aren’t available, investors can manually reinvest dividends by taking the cash and using it to execute additional trades within their brokerage. Some brokerages also provide commission-free dividend reinvestments. The added benefit of this approach is that investors have more control over the timing and execution of the trades.

It’s important to keep in mind that settlement periods may affect both DRIPs and manual reinvestment. The settlement period for most mutual funds is just one day, but stocks can take three or more days to actually receive cash in your account. This means that reinvestments may be delayed, which can impact the timing and pricing of the repurchases.

The Bottom Line

Dividends have a significant impact on stock returns that many investors fail to appreciate.

Total returns are the best way to compare the performance of different stocks since they account for the impact of distributions, coupons, and dividends. This is especially true for comparing the performance of dividend stocks with growth stocks.

If you’re looking for alternative ways to generate income from your portfolio, you may want to consider writing covered call options. Selling call options provides another person with the right to buy stock that you already own in exchange for an upfront premium that you keep. The goal is to collect the premium without having the stock called away. Covered calls are a great way to boost the income on a dividend paying company.

The Snider Investment Method provides a turnkey strategy for generating income from a portfolio of stocks by writing call options and collecting the premiums. The benefit is that you get to maintain a well-rounded stock portfolio without being forced into high-yield investments that tend to be higher risk.

For more information, take our free introductory course or contact us to learn about our managed options.