Many retirement investors are interested in bonds because they are both safer and more predictable than the stock market. Bonds pay out interest payments on a regular basis, and if held to maturity, repay the principal amount. If you’re holding highly rated bonds, the default risk is minimal compared to equities. They are ideal for those looking for predictable cash flow in retirement with little need for growth. There are two strategies that you can use to generate a consistent income from bonds — bond laddering or bond funds.

Let’s take a look at each of these strategies and what might be appropriate for your circumstances.

Bond ladders and bond funds are two common ways to generate a consistent income from bonds.

Quick Review

Before diving into the differences between bond ladders and bond funds, let’s start by reviewing how a bond works.

Bonds are fixed income investments whereby an investor loans money to a borrower for a defined period of time at a variable or fixed interest rate. Investors receive interest payments — or coupons — on a regular basis — typically twice per year — until the bond matures. When that happens, the investor receives the principal amount of the bond.

There are several different types of bonds:

- Government Bonds – These bonds are issued by the U.S. Treasury with maturities ranging from one to 30 years.

- Municipal Bonds – These bonds are issued by states and municipalities and may have tax advantages.

- Corporate Bonds – These bonds are issued by companies looking to raise capital outside of the equity market.

- Agency Bonds – These bonds are issued by government-affiliated organizations, such as Fannie Mae.

Bond Ladders

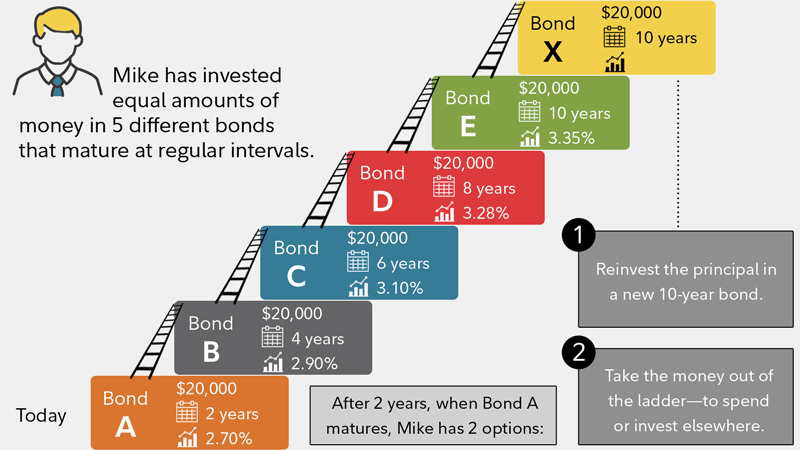

Bond ladders are the most common way to generate income from a portfolio of individual bonds. Rather than buying bonds with the same maturity date, you can stagger the purchase of bonds at different maturity dates to generate more consistent cash flow and reduce interest rate risk. Each time a bond matures, you purchase longer duration bonds at the prevailing rate.

Download our free checklist of bond funds for retirement investors to find an option that’s right for you.

Most bond ladders have at least six rungs to generate income every month of the year, but many experts recommend investing a minimum of $100,000 to purchase ten rungs for $10,000 each to generate a consistent income and diversify risk. These rungs should be equally spaced with longer ladders generating higher income and shorter ladders having less risk.

Let’s take a look at a great example from Fidelity demonstrating how a bond ladder is typically constructed and used by retirement investors:

How to Build a Bond Ladder – Source: Fidelity

Bond Funds

Bond funds are the easiest way to generate a regular income from a portfolio of bonds. Rather than building a bond ladder, you can purchase a mutual fund or exchange-traded fund (ETF) that holds a portfolio of bonds and pays out a regular dividend that’s funded by the bonds’ interest payments. The catch is that you must pay fees for professionals to manage the fund.

Don’t forget to download our free checklist of bond funds for retirement investors to find an option that’s right for you.

Most bond funds have no minimum investment, so it’s easy for investors to get started with less than $10,000. You only need to purchase a single bond fund to realize the benefits of a bond ladder/portfolio without the time, effort and expense of building your own portfolio. You also benefit from better liquidity and professional-grade due diligence.

Let’s take a look at an example:

The iShares Core US Aggregate Bond ETF (AGG) tracks an index of diverse U.S. investment-grade bonds, including U.S. Treasuries, agencies, commercial mortgage-backed securities and other debt. With an expense ratio of just 0.05%, you’re paying just $5 in fees for every $10,000 invested. The 2.7% annual dividend yield also provides investors with healthy cash flow.

Comparison & Alternatives

Let’s take a look at some important differences between bond ladders and bond funds that can assist you in deciding between the two options.

| Bond Ladders | Bond Funds | |

| Cash Flow | Fixed semi-annual payments. | Variable monthly income distributions. |

| Liquidity | Investors can sell bonds, but some markets may be illiquid and/or poorly priced. | Investors can sell fund shares at any time at the current net asset value. |

| Diversification | Investors must purchase multiple bonds across many issuers and durations. | Fund managers ensure proper diversification without as much upfront investment. |

| Minimum Investment | Generally, $10,000 per bond. | Cost of a single share. |

| Expenses | Mark-up or mark-down and a possible advisory fee. | Expense ratios, sales charges and other fees. |

| Maturity Date | Set maturity date. | No maturity date. |

As investors get closer to retirement, they often try to become more conservative and focused on income. In addition to bond ladders and funds, you can enhance the income for a stock portfolio using covered call options. This low-risk option strategy involves selling call options against an existing stock portfolio to generate premium income. You can combine many of the benefits of owning stocks with the cash flow associated with owning bonds.

We developed The Snider Investment Method to be a predictable way to generate this kind of cash flow. While covered calls are relatively straightforward, it’s hard to decide what stocks, strike prices, and expiration dates to use. Many investors are also uncertain of what to do if the stock price moves sharply higher or lower. We even address the underlying portfolio by showing you how much to allocate in a particular stock and how to find the right low-risk stocks.

You can take our free e-courses to learn more about how covered calls work or contact us about our managed portfolio options.

The Bottom Line

Bond ladders and bond funds are the two most common ways to generate an income from bonds. In many cases, investors are best off purchasing bond funds since there is a lower minimum investment, instant diversification and no need for in-depth due diligence and ongoing portfolio maintenance. That said, some high net worth investors could benefit from managing their own bond ladders to maximize income and reduce risk.

Sign up for our free e-courses to learn more about alternative ways to generate an income from your retirement portfolio using covered call options.