Many people see options as the Wild Wild West of the investment world, where you can earn a life-changing fortune or blow up your entire account in minutes. The truth is, they can be used in all different ways, ranging from adding leverage and risk to adding safety and income to a portfolio. When used effectively, options can be a great way to hedge against risk and generate income.

Let’s explore three strategies that you can use to reach your retirement goals.

Should You Trade Options?

Before diving into options trading, it’s worth considering your time commitment.

Options trading requires a degree of education and commitment that’s above and beyond typical stocks, bonds, and ETFs. So, if you’re a buy-and-hold investor who wants to minimize time in front of a computer screen or phone, you may want to avoid trading options or consider a hands-off asset manager who can make these trades for you.

But, if you’re willing to put in the time and effort to learn, and dedicate time each month to find, execute, and manage options trades, you may find that the rewards are well worth the extra effort. The good news is that there are many tools that can help streamline the process, including options-specific trading platforms and stock screeners.

Getting Started

Options require special permissions to use in any brokerage account. Generally, you must request options trading approval and answer a questionnaire that assesses your knowledge. Then, based on your responses and account details, your broker will assign an option trading level that defines what and how you’re permitted to trade.

Retirement accounts may have even more restrictions than conventional brokerage accounts. Nearly all brokers allow certain low-risk strategies, such as covered calls or cash-secured puts option trades in an IRA. However, most retirement accounts impose limits on margin trading (e.g., writing naked options with unlimited loss potential).

If you’re completely new to options, you may want to familiarize yourself with the basics before trading them. Our free Options Investing 101 e-course offers a comprehensive introduction to the topic, helping you master the fundamentals of options.

Boost Income with Covered Calls

Covered calls are one of the most popular options strategies for generating extra income. By writing a call option against an existing long stock position, you receive an upfront option premium that comes in addition to any stock dividends.

For example, suppose you own 100 shares of Apple Inc. (AAPL) and the current price is $200. If you wanted to generate a little extra income, you might sell a call option with a strike price of $210 and an expiration date one month from now for $250. After executing this covered call, you’d realize the equivalent of an extra 1.45% in annualized income.

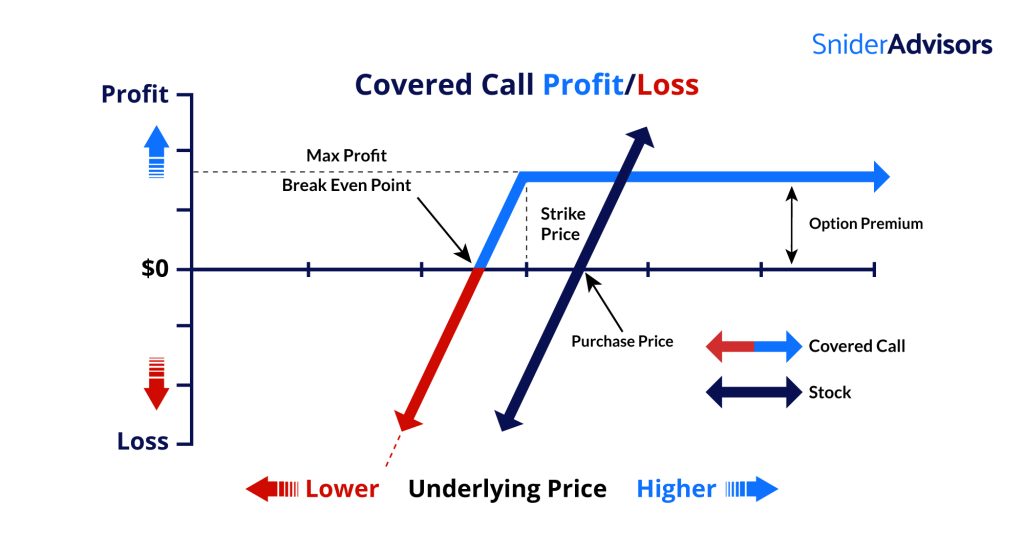

Covered Call Diagram – Source: Snider Advisors

There are three possible ways the trade could play out:

- The stock stays at $200, the option expires worthless, and you keep the $250.

- If the stock falls below $200, the option expires worthless, and you keep the $250, which helps offset any decline in the stock value.

- If the stock rises above $210, the buyer exercises the option, and you must sell the stock at $210 or buy-to-close the option prior to expiration to avoid assignment.

The biggest risk is that you miss out on a substantial upside. If Apple’s stock soars following earnings to $300, you would still have to sell for $210 and miss out on $90 per share in would-be gains. And these opportunity costs can add up over time.

You can avoid these risks by carefully selecting the best underlying stocks, finding the right option strike price and expiration dates, and managing any positions that run awry after the fact. If you want to learn more about these topics, Snider Advisors has a free Stock Selection 101 and Climbing to Profits e-courses covering selection and risk management.

Hedge Against Risk with Collars

Collars are an excellent way to temporarily protect an existing stock position from downside risk. For example, suppose you own 100 shares of Exxon Mobil (XOM) and you’re concerned about the near-term impact following rumors of a brewing conflict in the Middle East. You might sell call options and buy put options, creating a narrow profit-loss range until the options expire.

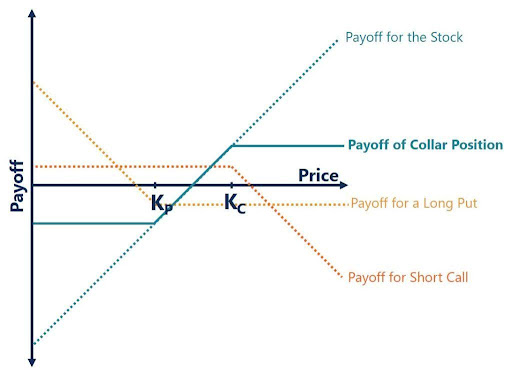

Option Collar Diagram – Source: Corporate Finance Institute

The long put strike price (Kp) represents the maximum amount you can lose since you have the right to sell at that price. Meanwhile, the short call strike price (Kc) is the maximum amount you could profit since you’re obligated to sell at that price. The breakeven is determined by how much the short call income offsets the long put costs.

Oftentimes, you can initiate a collar at a breakeven cost or a slight credit, making it a low-cost way to hedge against temporary losses. You can also define the timeframe without greatly impacting the cost since the two options generally offset each other. But, as with covered calls, the big risk is missing out on potential gains above the call strike price.

Collars are especially useful for avoiding capital gains taxes. For instance, rather than selling a stock after a sharp rally—if you’re worried about a retracement—you can implement a collar to limit your risk without triggering a taxable event. It’s especially beneficial to help hold positions longer than one year and benefit from the lower long-term capital gains tax rate.

Buy Stock with Cash Secured Puts

Cash secured puts can be an interesting way to acquire stock if you’re willing to wait. For example, suppose you want to purchase 100 more shares of Apple Inc. (AAPL) if the price falls to $190. Instead of just waiting for the price to fall, you could write (sell) a put option at $190, collect the option premium, and receive the stock (as an assignment) if it falls to that level.

You can also pair this strategy with covered calls in what’s known as the Option Wheel. The idea is that you can write a cash-secured put to generate income and serve as a limit buy order. If the stock gets assigned, you can write a covered call against it. If not, you can write a new cash-secured put to generate even more income. Once the cycle is complete, you start the wheel over again by selling a cash-secured put.

There are two risks with the strategy:

- The price could significantly increase before it reaches the strike price, and you would miss out on the would-be price gains. Of course, if you weren’t ready to purchase the stock anyway until a lower price, this isn’t an option-specific risk.

- The price moves sharply lower, and you’re obligated to buy at the potentially higher strike price of the put option. Given this risk, you should only establish cash-secured puts when you are prepared to own the stock, even if the price drops significantly.

The Bottom Line

Options may not be the first thing you think of for a retirement account. But when used effectively, they offer an excellent way to limit risk and increase income—two essential goals in any retirement portfolio. The key is taking the time to understand the ins and outs of these strategies.

If you want to learn more, Snider Advisors offers free covered call e-courses, or consider using the optionDash screener to find covered call or cash-secured put opportunities.