Covered Call Search

Free Covered Call Screener

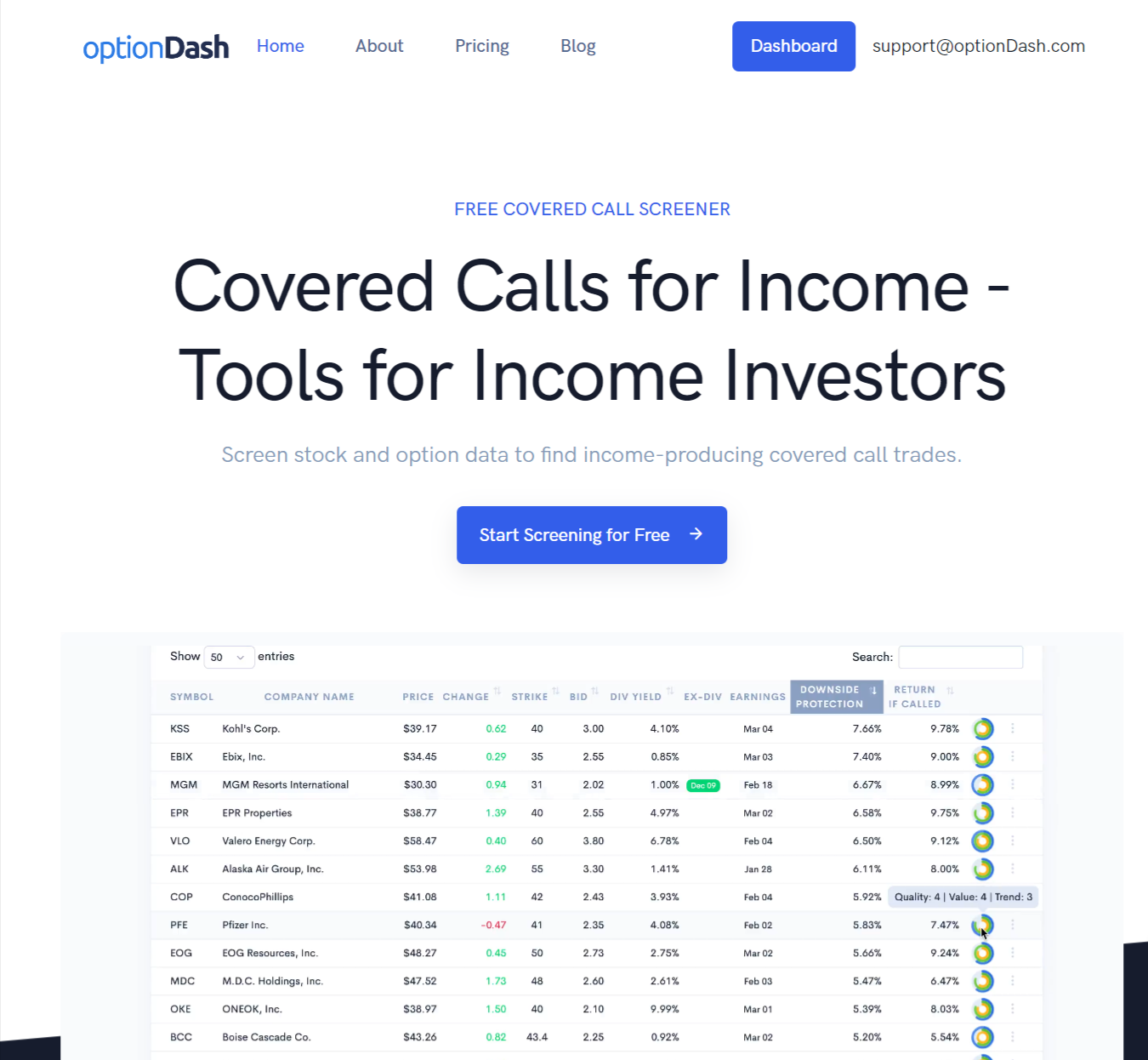

We recommend our partner firm, optionDash, for the best free covered call screener available to retail investors.

optionDash sorts through all the market data to find the highest income earning combinations of owning stock and selling a covered call.

We built this tool with the same powerful covered call screening criteria used to select stocks for the Snider Investment Method.

The best covered call screener on the internet.

- Free Covered Call Screener

- Proprietary Stock Scoring System

- Cash-Secured Put Screener

- Advanced Search Criteria

Covered Call Search

A dedicated tool for covered call and cash-secured put investing.

optionDash was designed specifically for covered call traders. Our covered call scanner helps investors filter all the parameters like stock price, option expiration, strike price, and much more to find the optimal income producing combination.

Using optionDash, you can quickly identify the right covered call trades for your portfolio. The simple interface and straightforward functionality can help you save time and find suitable stocks based on your specific criteria.

The Snider Investment Method is a complete system for managing a portfolio devoted to covered calls. optionDash is perfect for the investor simply looking for a call writing tool to generate income-producing covered call trades. With just a few simple clicks, you can analyze the thousands of different stocks and the multiple strike prices and expirations for each to find your ideal covered call opportunity.

The free covered call screener at optionDash puts you in control to filter by various advanced criteria. Along with a proprietary stock scoring system, optionDash can help you find the best income-producing covered call trades.

More Covered Call and Option Trading Education

We pride ourselves on empowering both beginner and experienced investors. As covered call advisors, we use our extensive knowledge to train our clients to write covered calls and boost the income from their portfolios.

About Us

Snider Advisors is a boutique, SEC-registered investment advisor. As professional covered call advisors, we have a fiduciary responsibility to our clients and a verifiable track record since 2002.

We have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. While we professionally manage approximately $75 million for clients, the Snider Investment Method, the powerful system thousands have learned to use and trust, accounts for over $100+ million in client-managed assets.

Unlike most advisors, we don’t manage money behind closed doors – instead, clients appreciate the transparency and education we provide, making them highly informed and confident investors. As a matter of fact, we use the same method to manage client assets that we teach clients to use to successfully manage their portfolios.