Retirement Planning Checklist

The Ultimate Retirement Checklist

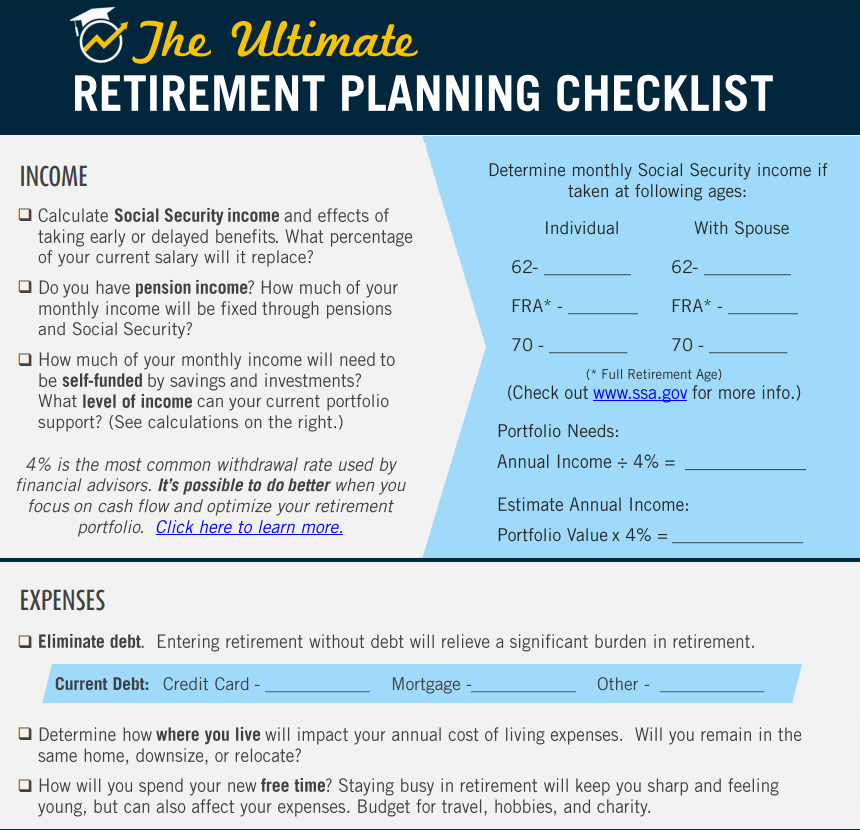

Use this checklist to consider all the high-level aspects of your retirement plan. It includes 6 critical components: Income, Expenses, Investments, Healthcare, Emergencies, and Legacy

Retirement Planning Checklist

A Perfect Cheat-Sheet to Enjoy Financial Security in Retirement

Retirement is not just about financial readiness but also about how one intends to spend their time. A checklist can help individuals set goals for travel, hobbies, volunteer work, or part-time employment, contributing to a fulfilling and purposeful retirement.

Our Ultimate Retirement Checklist is an invaluable tool that offers clarity, ensures comprehensive preparation, and facilitates a seamless transition into retirement, contributing to a more secure and enjoyable post-work life.

Retirement Planning Checklist

The Ultimate Retirement Planning Checklist

Our retirement checklist serves as a comprehensive guide to ensure near retirees are thoroughly prepared for this life transition. Outlining essential steps and considerations, this checklist offers a multitude of benefits, making the journey into retirement smoother and more secure.

First, our retirement checklist aids in financial planning, ensuring that all financial aspects are considered and addressed. This includes savings, investments, pensions, and any debts that need to be managed. It helps individuals assess their financial readiness, allowing them to make informed decisions about when they can afford to retire and what lifestyle adjustments might be necessary.

Next, our checklist prompts consideration of healthcare needs, a critical component of retirement planning. It encourages individuals to explore options for health insurance, understand Medicare, and safeguarding against unexpected medical expenses.

Lastly, walking through the Ultimate Retirement Checklist fosters peace of mind. It addresses potential concerns and uncertainties, allowing for a proactive approach to planning. This thorough preparation not only reduces the risk of unforeseen challenges but also enhances confidence in one’s ability to enjoy a comfortable and rewarding retirement.

Evaluate Your Retirement Readiness

The Ultimate Retirement Planning Checklist

A simple checklist to give you a clear snapshot of how to prepare for your retirement.

Social Security Evaluation

Consider your social security income benefits, including early or delayed payments.

What part will it play along with other income sources?

Investment Income

What level of income can your current portfolio support? And, how it is possible to do better!

Debt Evaluation

Eliminate “bad” debt before retirement and control the large expenses that harm many retirees.

Estate Planning Review

What legacy will you leave for your heirs? Simple steps to make your estate process simpler.

About Us

Snider Advisors is a boutique, SEC-registered investment advisor. As professional covered call advisors, we have a fiduciary responsibility to our clients and a verifiable track record since 2002.

We have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. While we professionally manage approximately $75 million for clients, the Snider Investment Method, the powerful system thousands have learned to use and trust, accounts for over $100+ million in client-managed assets.

Unlike most advisors, we don’t manage money behind closed doors – instead, clients appreciate the transparency and education we provide, making them highly informed and confident investors. As a matter of fact, we use the same method to manage client assets that we teach clients to use to successfully manage their portfolios.